Forecasting & Planning

for Venture Funds.

Unified platform for portfolio modeling, management & reporting.

Zero spreadsheets.

Slack Community

Join our Slack community for helpful tips, discussions and latest announcements related to Tactyc

Multiple Use Cases

Fundraising. Deployment. Reporting.

Build portfolio construction models

Add actual deals & compare performance with plan

Strategize future rounds and optimize reserves

Model probabilistic exit scenarios

Gather insights to improve fund performance

Track and request portfolio company KPIs

Create LP-ready reports

Portfolio Construction.

Build a rock-solid construction model for your fundraise in minutes.

Market Benchmarks

Develop a construction strategy based on real-world datasets of round sizes & valuations.

Precise Reserve Planning

Develop customized check size and reserve strategies based on types of investments.

Flexible Waterfalls

Model European and American waterfalls with customizations in minutes.

Impress LPs

Share your construction model with LPs with a visually engaging dashboard

Portfolio Forecasting & Planning.

Plan reserve deployment and exit scenarios with a live forecast of your active portfolio.

Compare Actual Performance vs. Plan

Find course-correction strategies to improve portfolio's performance.

Round Modeling & Returns Analysis

Easily model and set reserves by deal for future rounds to evaluate dilution and return impacts.

Investment Scenario Analysis

Model upside and downside exit scenarios for each deal by setting probabilities for exit outcomes.

Fund Scenario Analysis

Evaluate fund upside and downside scenarios based on scenarios defined for each deal.

Market Intelligence

Build forecasts based on market intelligence and transaction comps from real-time market data.

Cash Planning

Estimate cash flow and liquidity needs and model line of credit drawdowns.

Reserve Optimization

Allocate reserves towards companies with the highest upside potential and lowest downside risk.

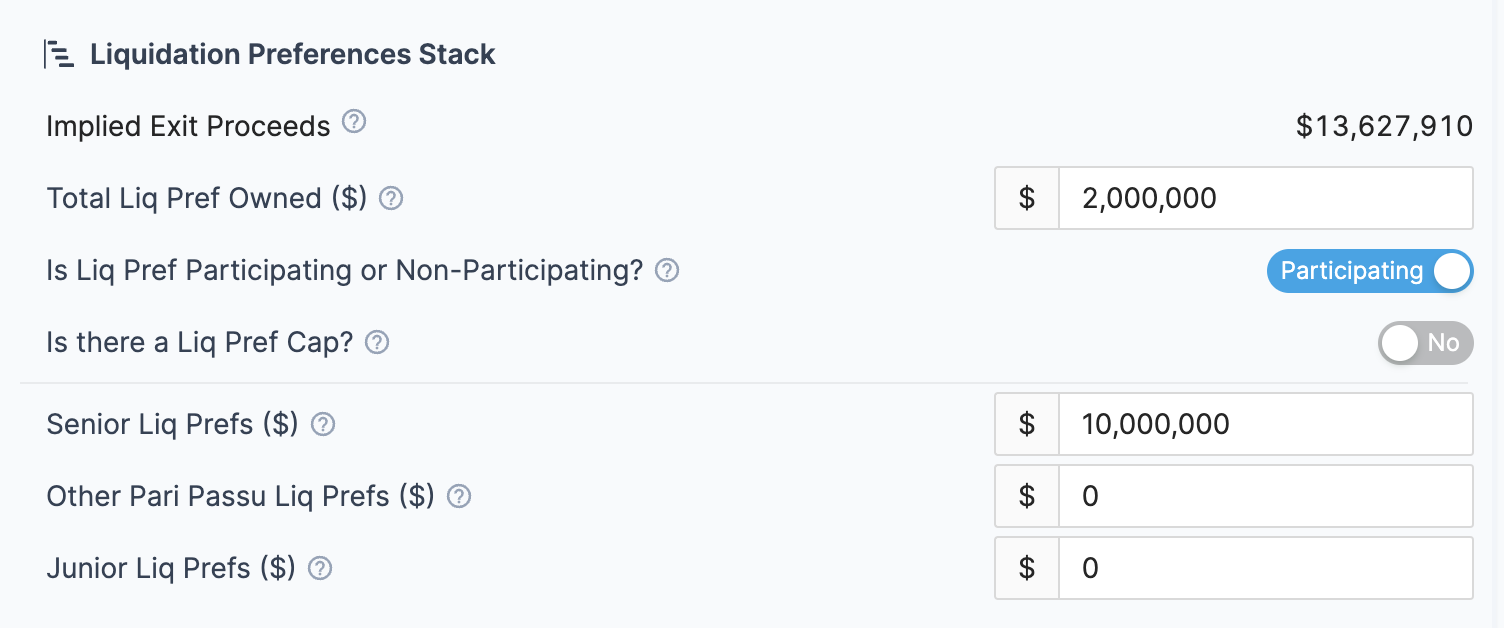

Liquidation Preferences and Partial Exits

Easily analyze impact of liquidation preferences and model partial exits.

Portfolio Management & Reporting.

Organize and track portfolio company KPIs and deal documents.

Track Portfolio Company KPIs

Flexible interface to track and request quantitative or qualitative KPIs directly from portfolio companies.

Portfolio Insights in Seconds.

Filter and pivot on 70+ portfolio performance metrics to evaluate performance by geography, industry, co-investors, and more.

Multi-Currency Support

Track rounds in multiple currencies and automatically perform exchange rate conversions.

Time Machine

Rollback the fund to any point in time to view historical performance.

Intelligent Visualizations

Identify patterns and trends with interactive visualizations and charts.

Enriched Reporting

Pre-built and customizable reports & tearsheets that enable 1-click external LP reporting.

Schedule Demo

See Tactyc by Carta in action.

Book a Demo

.jpg)